Industry: Banking

Navigating BaFin Compliance with Ease: A BaryTech Success Story

Facing the intricate regulatory landscape set by BaFin, the German Federal Financial Supervisory Authority, the organization embarked on a mission to streamline its reporting processes. This case study delves into the challenges, strategies, and outcomes of this initiative, highlighting the innovative solutions employed by BaryTech to ensure compliance, enhance operational efficiency, and save valuable resources.

70%

Streamlined Data Collection and Reporting

90%

Compliance Accuracy and Timely Submissions

80%

Future-Proof SaaS Development

Client Overview

Our clients are leading German banking institutions, each with a rich history and a significant presence in the banking and financial services sector. With extensive networks of branches and offices both domestically and internationally, these banks are committed to enhancing their IT infrastructure and business operations to meet evolving regulatory and operational demands.

- Industry: Financial Services

- Project Location: Germany

- Project Status: Completed

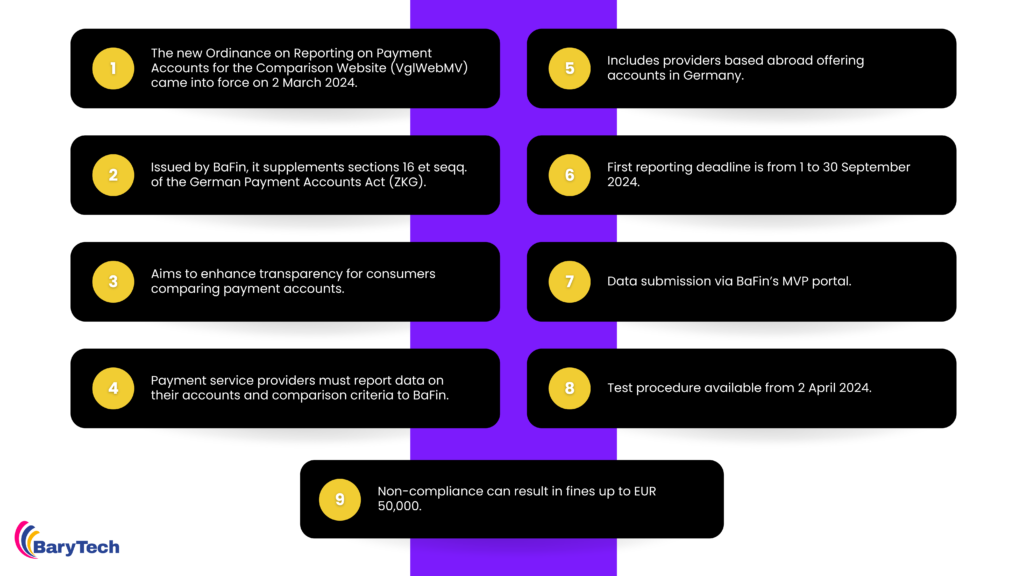

Project Challenges

- Regulatory Compliance: Banks needed to meet BaFin’s strict standards and deadlines, with the initial report due by 30 September 2024 and subsequent quarterly reports.

- Technical Complexity: The task required a deep understanding of XML and XSD files for accurate report preparation and submission.

- Submission Methods: Banks had to choose between uploading an XML file via the MVP Portal or submitting a report via SOAP web service, adding to the complexity.

BaryTech Solution

Recognizing the complexity and technical demands of the task, BaryTech proposed a streamlined solution to assist the bank. Our approach involved:

Simplified Data Collection

We created a user-friendly questionnaire to efficiently gather all necessary information about the bank’s payment account services, aligning with BaFin’s reporting requirements.

Expert Report Preparation

Leveraging our technical expertise, we prepared the XML report based on the data collected through the questionnaire. Our team ensured that the report was meticulously structured and validated against BaFin’s XSD schema.

Seamless Submission

We facilitated the submission of the prepared XML report via the MVP Portal, ensuring compliance with BaFin’s submission guidelines and deadlines.

Implementation

The implementation phase was characterized by meticulous planning and collaboration.

- Requirement Gatherings: We initiated the project by conducting in-depth discussions with the bank to understand their payment account services and the specific data required by BaFin. This phase was crucial for identifying all necessary information and ensuring that the questionnaire would capture comprehensive data.

- Questionnaire Development: Our team designed a detailed questionnaire that was easy for the bank staff to complete. The questionnaire included sections on various aspects of payment account services, such as fees, features, and customer demographics.

- Data Collection and Validation: The bank staff used the questionnaire to provide detailed information about their payment accounts. Our team then reviewed the collected data to ensure accuracy and completeness.

- XML Report Preparation: Using the validated data, our technical team prepared the XML report. This involved structuring the data according to BaFin’s specifications and validating the XML file against the provided XSD schema to ensure compliance.

- Submission: The final XML report was uploaded to the MVP Portal. We coordinated closely with the bank to ensure that the submission was completed on time and that all regulatory requirements were met.

Tools and Technologies

XML

Used for structuring the report data in a format that could be easily processed and validated.

XSD

Employed to define the structure and data types of the XML files, ensuring that the reports met BaFin’s schema requirements.

MVP Portal

BaFin’s platform for XML report submissions. Our team ensured a smooth and compliant submission process.

Outcome

Efficiency

The bank was able to meet BaFin’s reporting requirements without diverting significant internal resources. Our solution streamlined the data collection and report preparation process, saving the bank time and effort.

Accuracy

The XML reports were prepared with a high degree of accuracy, ensuring compliance with BaFin’s regulatory standards. Our validation processes minimized the risk of errors and ensured that the reports were complete and correct.

Simplicity

The use of a simple, user-friendly questionnaire made the data collection process straightforward for the bank staff. This approach reduced the complexity of the task and made it easier for the bank to provide the necessary information.

Timeliness

All reports were submitted on time, avoiding any potential penalties or compliance issues. Our project management and coordination ensured that all deadlines were met and that the bank remained in good standing with BaFin.

Technical Implementation and Deadlines

If you’re a bank or financial institution seeking expert assistance with BaFin regulation reporting, we’re here to support you. Contact us now, and we will work together to ensure compliance with all regulatory requirements. Our streamlined process makes it easy for you to get the support you need. Let’s get started!

Timeline for Completion

The banks will need to provide us with the necessary information by answering our questions to help us understand their services. The time required for this phase will depend on how quickly the bank can supply all the information.

- XML Report Preparation: This phase will take no more than a day, depending on the size of the bank and the range of services they offer. Once the bank provides all the required information, we will complete the XML report preparation.

- Data Submission: As soon as we have the data, the process will take from a few hours to a day. We will fill in the data, submit it to you for validation, and then proceed with the final submission.

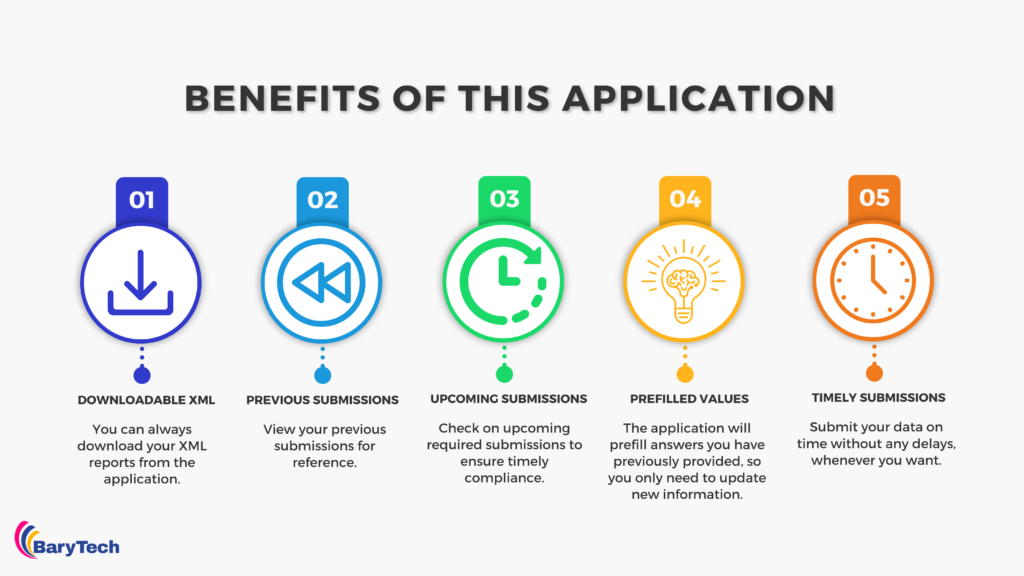

Future Developments

For the future, we are planning to develop a SaaS-based application that will provide the latest and updated questions in different categories. Once you select your category, you will need to sign in to ensure your data is secure. You will then find all the updated questions sourced from BaFin, which you can fill in and submit directly from the application.

In Phase 2 of this software, we will directly connect it with the BaFin portal via the SOAP API, further streamlining the submission process.