Industry: Financial Services

Ensuring Digital Operational Resilience with DORA Compliance

A detailed overview of how BaryTech enabled a leading European financial institution to achieve full DORA compliance by implementing a robust ICT risk management framework, enhancing digital resilience, regulatory confidence, and operational continuity.

85%

Improvement in Incident Response Efficiency

90%

Audit-Ready Regulatory Reporting Achieved

75%

Visibility into Third-Party ICT Risks and Dependencies

Client Overview

Our client is a prominent European financial institution recognized for its extensive presence in international banking and financial services. Operating through a broad network of branches and strategic hubs, the organization oversees high-value transactions and critical digital assets. To stay ahead of evolving regulations and ensure resilient IT operations, the institution continuously invests in enhancing its cybersecurity, risk management, and operational frameworks.

- Industry: Financial Services

- Project Location: Europe

- Company Size: 50,000+

- Project Status: Ongoing

Project Challenges

The client, a leading European financial institution, faced growing concerns over ICT-related risks – including cybersecurity threats, third-party dependencies, and potential system disruptions. With increasing digital reliance, even a minor ICT failure could lead to cascading operational, financial, and reputational impacts. As the EU’s Digital Operational Resilience Act (DORA) approached enforcement in January 2025, the organization needed to establish a comprehensive, compliant, and future-ready resilience framework – ensuring uninterrupted operations and regulatory confidence.

Key pain points included:

- Managing ICT-Related Risks: Heightened exposure to cybersecurity threats, vendor dependencies, and potential system failures across business operations.

- Ensuring Operational Continuity: Rising digital dependence meant any ICT failure could rapidly escalate, impacting financial performance and institutional reputation.

- Achieving Regulatory Readiness: With DORA enforcement imminent, there was an urgent need to put in place a robust and compliant operational resilience framework to guarantee uninterrupted service and regulatory assurance.

BaryTech Solution

BaryTech delivered an end-to-end solution to help the client achieve robust DORA compliance and digital operational resilience, we:

DORA-Aligned ICT Risk Framework

BaryTech partnered with the client to design and implement a robust DORA-aligned ICT Risk Management Framework that exceeded standard compliance requirements by integrating proactive risk assessment, continuous monitoring, and adaptive controls

Resilience Through Design Architecture

Our objective was to embed resilience by design, ensuring that the client could withstand ICT disruptions effectively, respond promptly to incidents as they arise, and recover swiftly with minimal impact on business operations.

Unified Operational Ecosystem

We focused on five key pillars of DORA - Risk Management, Incident Reporting, Resilience Testing, Third-Party Oversight, and Threat Intelligence Sharing - creating a unified operational ecosystem for risk governance and digital continuity.

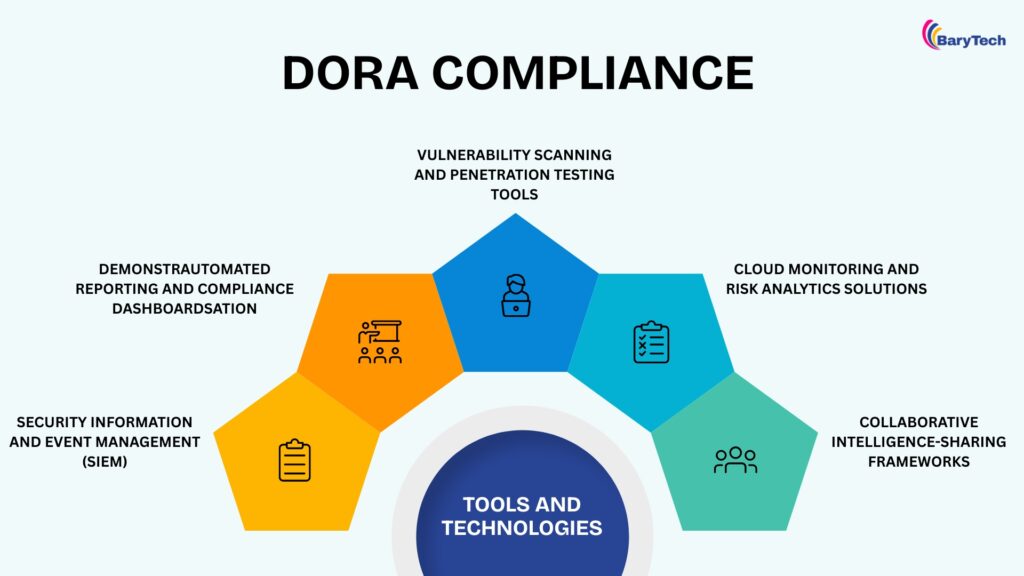

Tools and Technologies

Implementation

BaryTech conducted a thorough digital resilience assessment, established clear governance, implemented incident response processes, validated resilience through testing, managed third-party risks, and integrated automated compliance tools to strengthen operational resilience efficiently.

- We conducted an end-to-end digital resilience assessment, identifying vulnerabilities across infrastructure, applications, and vendor networks.

- We established clear governance and accountability frameworks, aligned with DORA’s board-level oversight requirements.

- A standardized incident response and reporting process was implemented, enabling real-time visibility and rapid escalation across business units.

- Through penetration testing, threat-led simulations, and continuous monitoring, resilience was validated across critical systems.

- Additionally, we developed a third-party risk management model that ensured transparency, compliance, and contractual control over key ICT vendors.

- To support sustainability and scalability, we integrated automated compliance monitoring tools and established regular resilience review cycles.

- This holistic approach not only strengthened the organization’s operational resilience posture but also enhanced cross-departmental collaboration and decision-making efficiency.

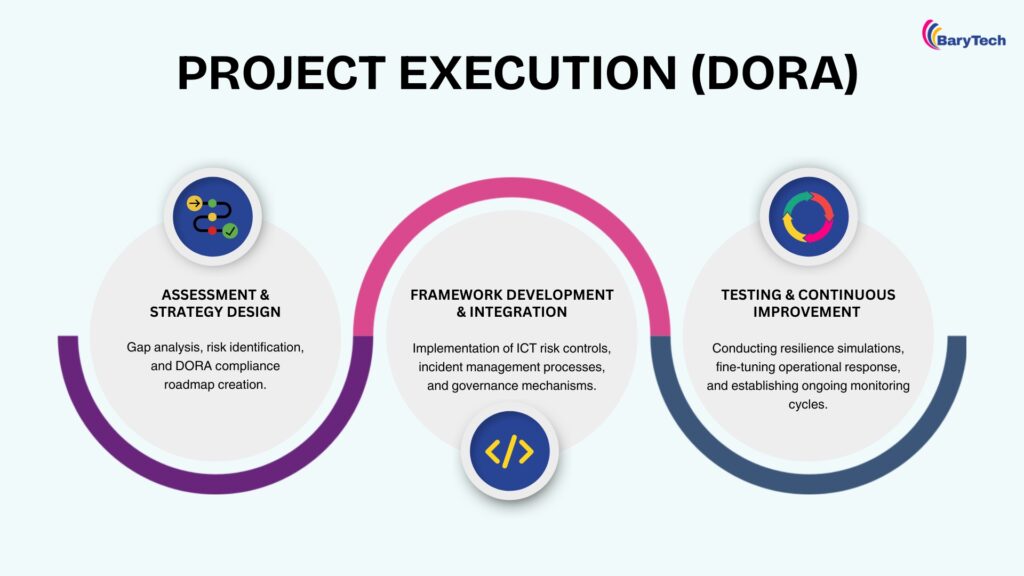

Project Execution

Outcome

The implementation empowered the client to achieve full DORA readiness, enhancing its ability to anticipate, withstand, and recover from ICT disruptions. Key results included:

Incident Response Efficiency

40% improvement in responding to operational incidents.

Cyber Resilience & Trust

Strengthened business continuity and enhanced market credibility.

Third-Party Risk Transparency

Complete visibility into ICT dependencies and vendor risks.

Regulatory Reporting & Compliance

Streamlined readiness for audits and regulatory inspections.

With BaryTech’s DORA-driven framework, the client transformed compliance into a strategic advantage – reinforcing operational resilience, regulatory confidence, and long-term digital trust.

If you’re a financial institution looking to strengthen digital operational resilience, streamline ICT risk management, and ensure full DORA compliance, BaryTech can help.

Contact us to safeguard your systems and maintain seamless business continuity with expert solutions tailored to your needs.